International Tax Services

BPM’s International Tax Services (ITS) Practice represents a compelling value proposition: ready access experts who provide high-value specialized international and transfer pricing services.

Our ITS professionals have worked in the U.S. Tax Court, the U.S. Treasury Department General Counsel’s office, the IRS National Office, and senior-level corporate and consulting firm positions in Europe, Asia, Mexico and Latin America.

We assist companies at all stages of growth, from pre-formation and start-up, through early-stage and mid-market, to Fortune 50 multinationals. The depth and breadth of our international tax and transfer pricing expertise and experience ensures that you receive value-added insights and top-tier services that you can trust in even the most complex cross-border situations.

We specialize in mid-market and early-stage companies, offering the complete range of U.S. and foreign international tax and transfer pricing services. In addition to international tax strategic planning, consulting, compliance and tax provision services, our ITS practice includes a full-service transfer pricing team, enabling us to meet any and all of your global cross-border needs.

BPM’s Allinial Global Network

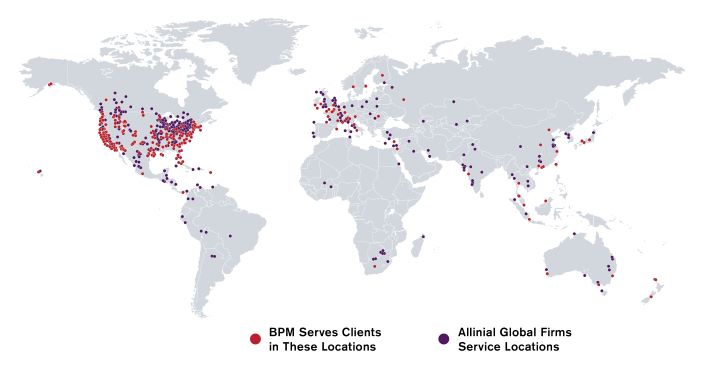

BPM is a selected partner of Allinial Global, an international accounting association that connects us to nearly 200 member firms around the globe. These connections give us access to the best local tax and accounting expertise anywhere in the world, allowing us to offer diverse services with broader industry expertise,and provide greater value for our international clients.

Related Services

- Global Tax Strategy Consulting

- Global Business Model Optimization

- International Expansion: Mid-Market and Early-Stage

- IC-DISC Export Tax Incentive

- U.S. Inbound International Tax

- Intellectual Property Tax Planning

- Transfer Pricing

- International Tax Quantitative Services

- International Mergers and Acquisitions

- International Tax Compliance and Provision

- Indirect Tax (VAT or GST)

- International Assignment Tax

- Mexico & Latin America Tax Services

- Multinational Families

- IRS Voluntary Disclosure Program

- China Tax Services

- Canadian companies doing business in the U.S.

- Ukrainian Tax Services