Vintners from across the state give a revealing look at how small to medium businesses weathered a chaotic and disruptive 2020.

By Abe Valdez Bravo, Senior Lead Economist

California's wine industry is a multibillion-dollar business. It employs thousands across the state, creates a world-class product, and is internationally renowned for its quality and productivity. Sadly, it was also hit by several crises beyond its control in 2020. The global pandemic not only put millions out of work but forced retail locations to close. There was little precipitation as well as damaging wildfires that not only burned vineyards and stock, but also ruined entire crops of grapes with smoke taint. Despite this, the industry still managed to see around $40 billion in sales, down by 8.25% from 2019.

However, the industry did not feel the pain equally. Some established companies felt little-to-no impact, while newer organizations faced more significant difficulties. But quantifying these realities is a challenge. While some of the most prominent players in the state are publicly traded companies with data readily available, information on small-to-medium producers was not easy to acquire.

That is why BPM launched its first annual California Wine Industry Survey. The results illustrate the importance of experience, the diversity of the industry, and how different business models fared when faced with significant headwinds. We reached out to 42 California operations with revenue between $1 million and $100 million to get answers on topics like inventory levels, margins, and production during a challenging year.

The results give fascinating insights into the industry and will be used as benchmarks for future surveys.

Sales and Margins

First, it is essential to know that there are generally four distinct business models at play in the state. They are:

-

Wine grape grower: They grow and sell grapes to other wineries for processing, usually on long-term sales contracts.

-

Wineries without vineyards: They buy grapes from growers to produce their wine.

-

Wineries with vineyards: They grow their grapes and make wine. Can purchase additional grapes.

-

Virtual wineries: Does not make wine. Instead, it brings completed wine to market and sells under its own brand/label.

One striking result from the survey is the difference in sales and profit margins the various business models produce. Wineries with vineyards saw the highest average gross sales, averaging $28.8 million, but they had the second tightest margins at 2.8%. These producers face the most complexities in the wine industry in dealing with the recession, pandemic, wildfires, and nature.

On the flip side, grape growers averaged the lowest sales at $5.5 million but had the biggest margins at 23.3%. Grape growers are the first link in the wine industry chain. They are the major supplier for wineries without vineyards and enjoyed the highest margins in 2020 likely because long-term contracts protect them.

Virtual wineries had the lowest margins at 2.3%, with gross sales coming in just below $13.7 million. Their margins are tight because they need to spend money on marketing and distribution in a highly competitive global marketplace. The bulk of their sales come from online, grocery stores and wine/liquor stores.

Finally, wineries without vineyards saw the second-highest sales, at around $17.3 million, and margins at 6.9%. These operations saw a medium impact from the turbulence of 2020, including the pandemic, recession, and wildfires.

Inventory and Production Levels

The headwinds from 2020 significantly impacted how the four business models dealt with their inventory levels and the quantity of stock they produced. The survey respondents saw their inventories grow between 0% and 15%, leaving some with more extensive inventories than they usually carry.

As we can see from the chart, grape growers had the highest dollar amount of inventory, averaging $57.5 million. Since they sell their grapes to other vintners, they do not produce any wine.

Virtual wineries had the second-largest inventory in dollar amounts, averaging just over $51 million. However, they also produced the most wine, coming in at just under 133,000 cases. Production levels are the highest because they order wine from other producers well in advance and do not have the flexibility to alter contracts when faced with business difficulties.

Wineries without vineyards had the lowest inventory levels, averaging $19.5 million. They also produced the fewest cases of wine at just under 82,000. Meanwhile, wineries with vineyards averaged $29 million in inventory while producing just under 84,000 cases. This business model enjoys the most flexibility when it comes to production. They can decide to not make new wine when faced with challenges or economic hardships.

Impact on Business

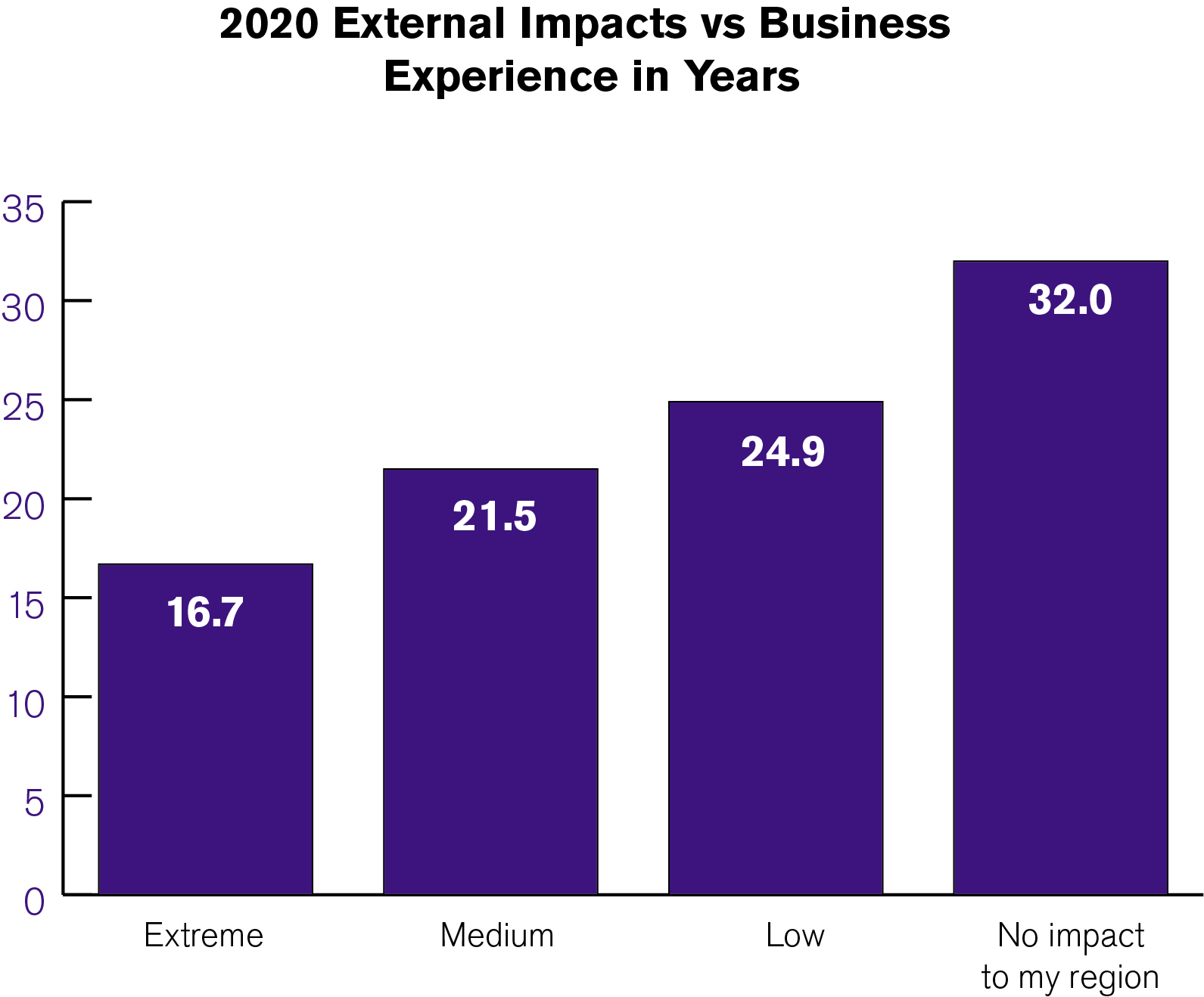

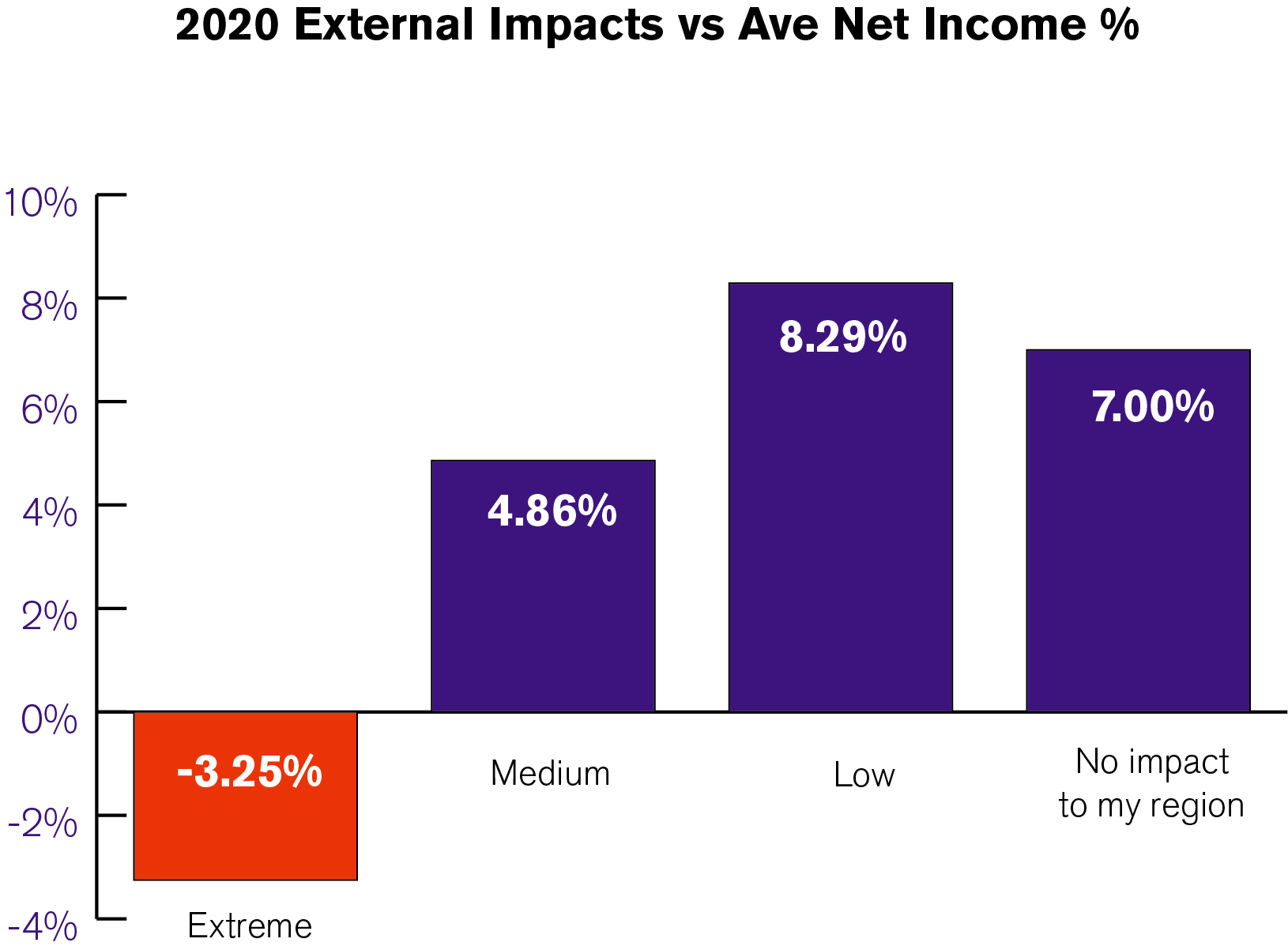

The survey results showed one clear point across all four business models: Experience can make a major difference in how a business weathers a storm like 2020. Companies with more than 24 years of experience reported little-to-no impact on their operations. They also saw margins of between 7% and 8.3%. Conversely, newer businesses reported extreme-to-medium impact while reporting a drop in margins by as much as 3.25%. The obvious takeaway is that industry veterans have experienced similar challenges and knew how to react quickly to mitigate damages or risks to the business at the first signs of trouble.

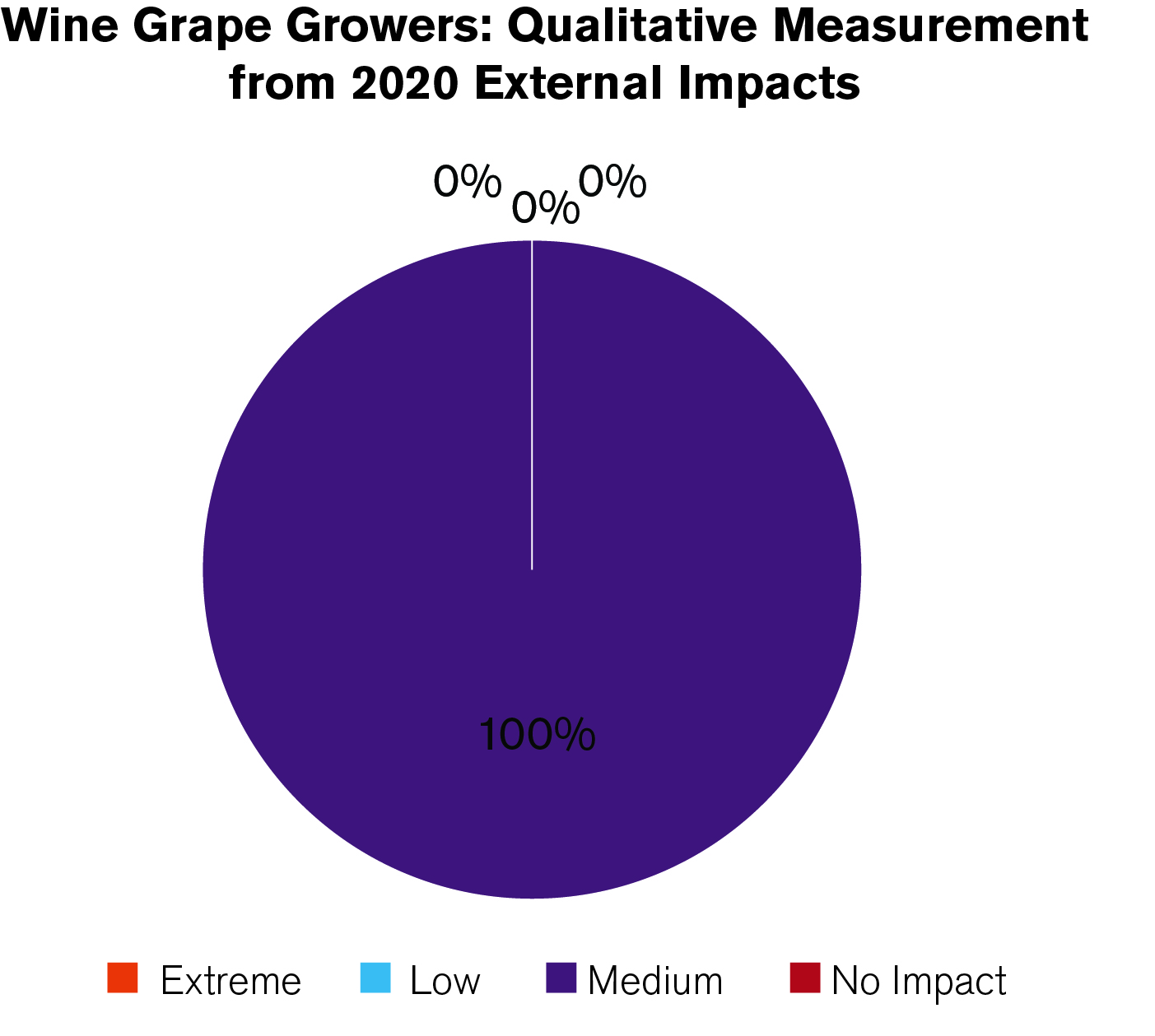

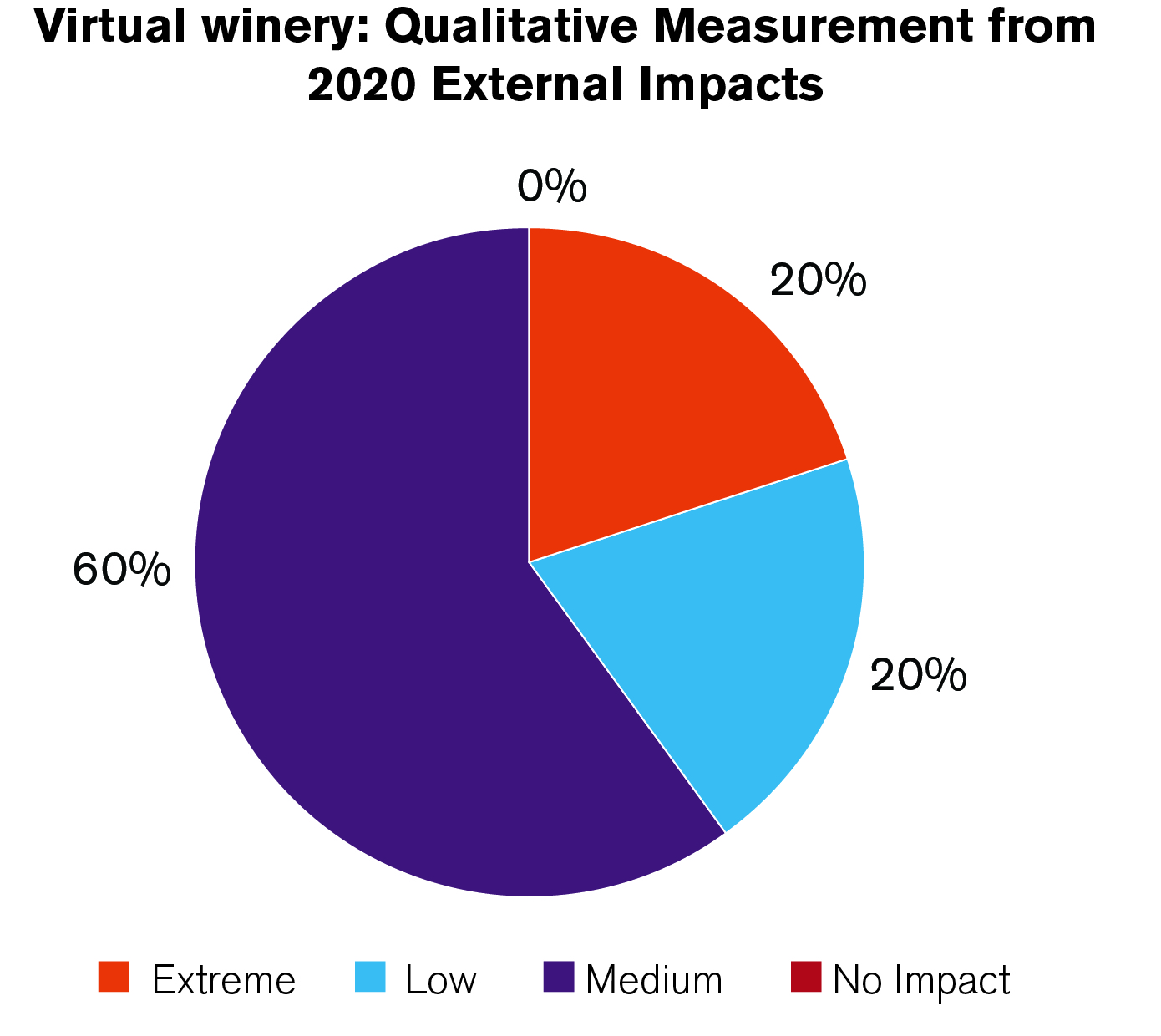

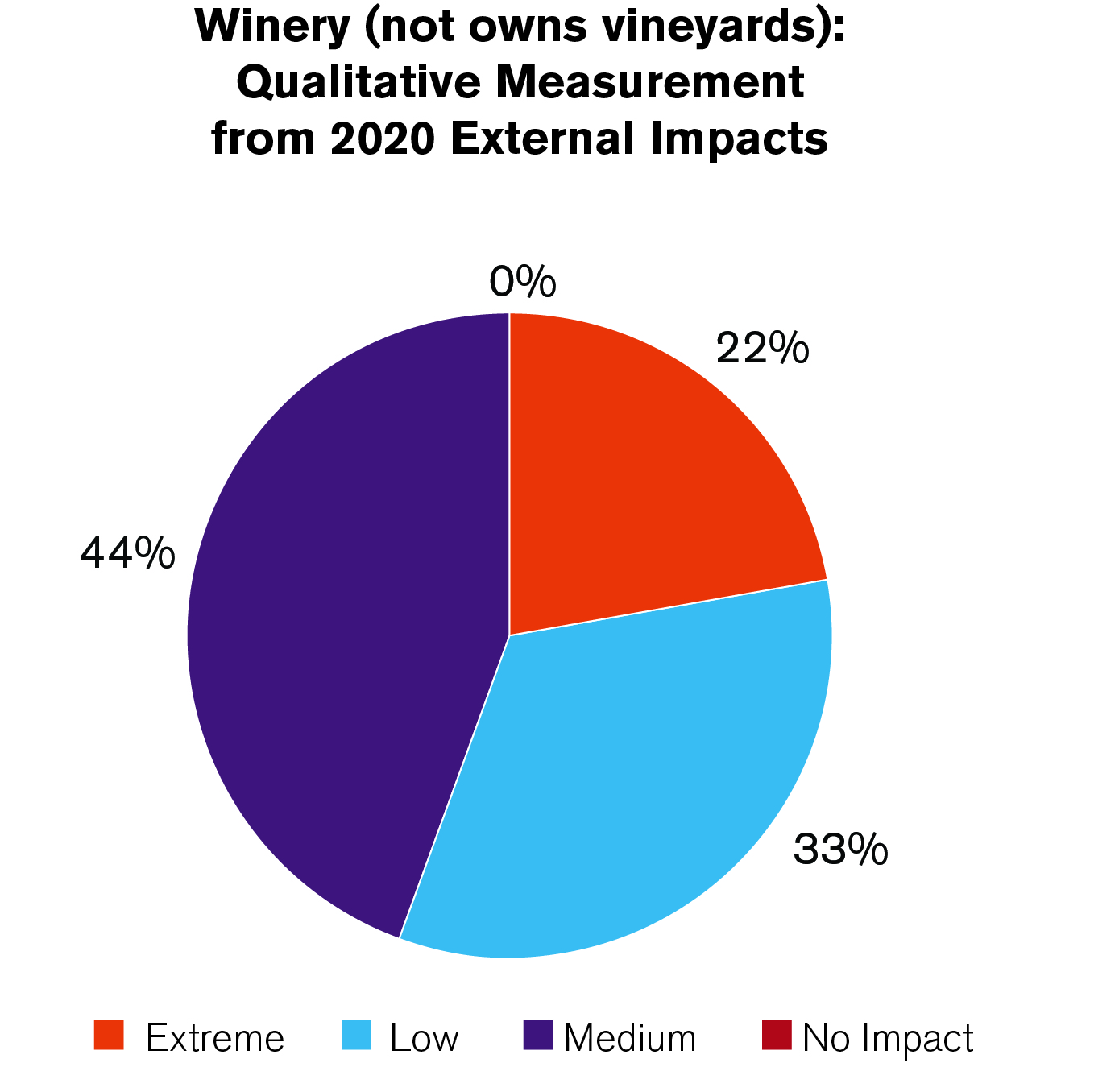

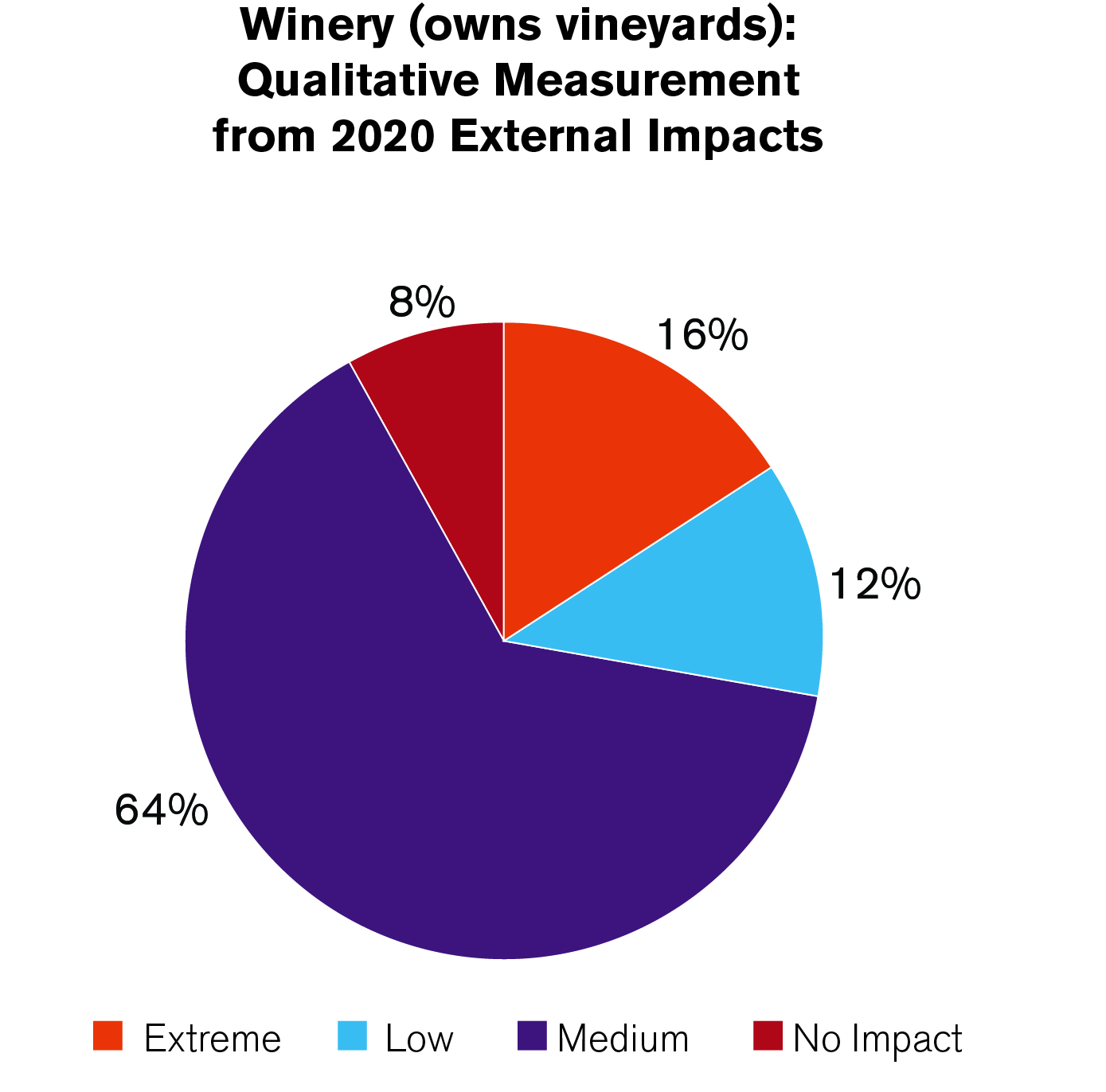

It is also interesting to see which business models experienced the most impact. Grape growers unanimously responded that they felt a medium impact from the events of 2020. Meanwhile, 8% of wineries with vineyards said they saw no effect, which is the only group with this response. Yet 80% of both virtual wineries and wineries with vineyards felt a medium and extreme impact, while only 66% of wineries without vineyards shared this response.

Closing Thoughts

California's wine industry is a resilient business that has faced innumerable challenges well before 2020. It has survived drought, extreme weather, wildfires, and recessions. However, having some figures now for the small to medium players in this sector is vital to understand the impact these events have on this vital sector of the state's economy. BPM will continue to conduct this survey from now on to help wine industry professionals understand how they stand against their peers and illustrate new ways of operating in difficult times.

To get in-depth analyses of this survey customized to your business, or to learn more about how our Economic Consulting Services can shed light on your company’s business environment, contact Abe Valdez Bravo, Senior Lead Economist and Director in our Advisory practice, today.