Don’t sleep on this chance to get valuable business advice.

By Winny Wong, CPA

As a business leader, if you are not seeking advice from your CPA frequently, you may be overlooking an opportunity to receive terrific advice.

Certified Public Accountants are trained to provide the highest level of accounting and tax knowledge. But meetings with your CPA can also serve as platforms to discuss other topics of relevance to your business. Moreover, frequent meetings have the potential to improve the quality and timeliness of the information you receive to better inform the decisions you make every day.

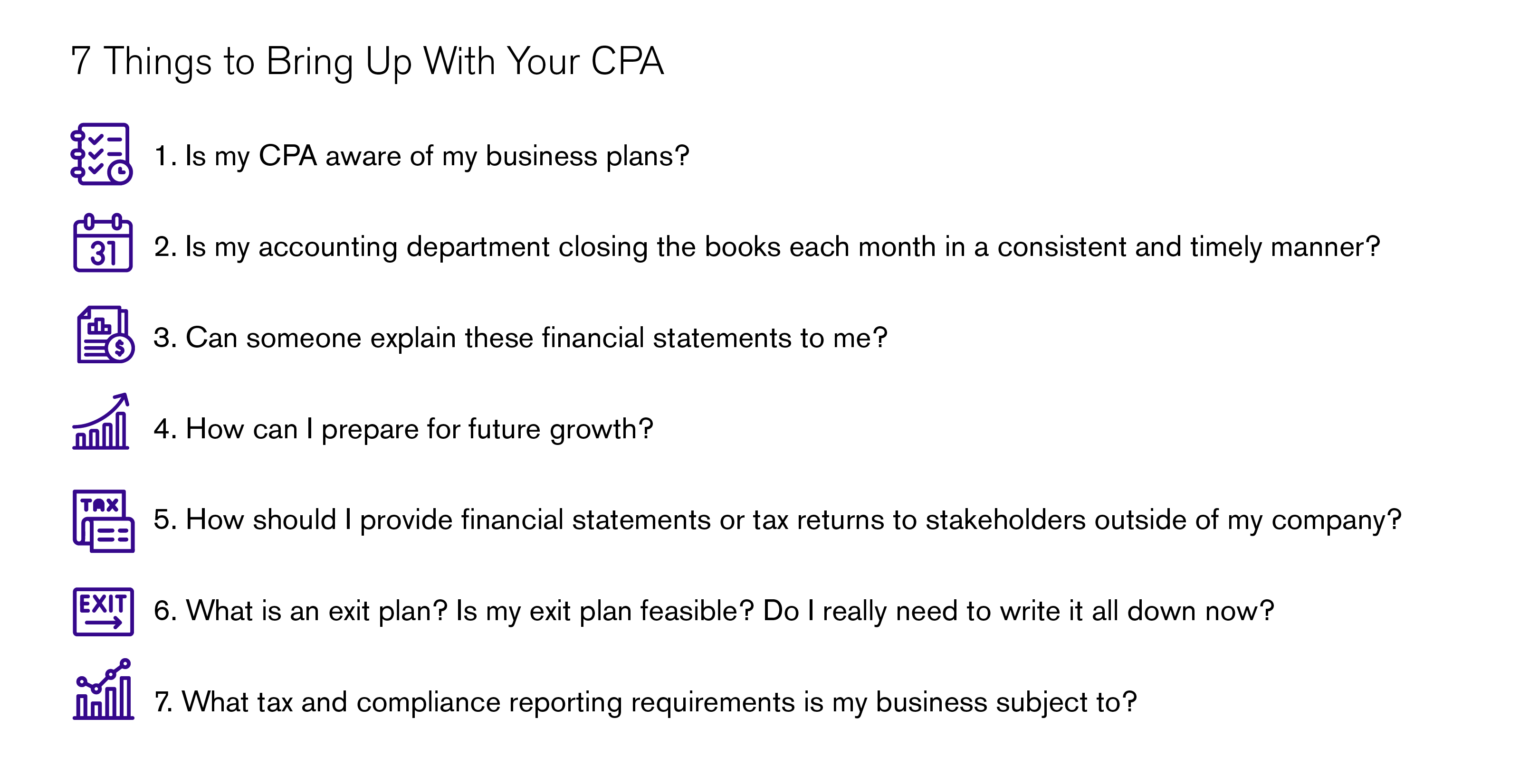

Here are several things that you should discuss with your CPA to ensure you are receiving the right information, at the right time, and have your accounting team operating at optimal level.

1. Is my CPA aware of my business plans?

It is important to let your CPA know of your plans for your business as these may have accounting and tax implications. For example: During a meeting to go over the financial statements, a client once notified our team that they were planning on lending money to one of their founders — but were undecided on whether to charge interest. We were glad the plan was brought to our attention so that we could recommend that they use the IRS Applicable Federal Rate for the loan to avoid unnecessary tax complications down the line.

2. Is my accounting team closing the books each month in a consistent and timely manner?

This should be done every month, on time, like clockwork. If the date that the monthly reporting package will arrive in your in-box has become a guessing game, your CPA can identify the steps required to streamline the system and accelerate the process.

The same is true for the interim reports you need on a more frequent basis, such as weekly sales reports or daily cash positions.

Setting up a consistent close schedule offers multiple advantages for your business:

- Tax planning: Your CPA may request your year-to-date financials to plan your taxes accordingly.

- Address accounting issues early-on: Whether you are engaging a CPA to close your books or have your own in-house accounting team, closing the books consistently on schedule may help them identify issues and correct them in a timely manner so that problems do not spiral.

- Avoid year-end crunch time: During year-end, there are quite a few reporting requirements that require books be closed within a tight turnaround, including 1099 filing, tax returns, investors and loan covenants. Consistent closes throughout the year help set you up for success at year-end.

3. Can someone explain these financial statements to me?

Financial statements are not always intuitive for everyone, including business executives. If your accounting team is sending you an email with your financial reports and a message that says “Here, you go. Have a nice day,” then there is a problem with that delivery. Not only should your accounting team explain the financial reports to you, but they should also note trends and fluctuations that ought to be brought to your attention and answer any questions you may have. This is where your CPA can provide additional support, including the time and attention to help you to easily extract the information you need from the financial reports you receive.

4. How can I prepare for future growth?

Do you foresee significant growth in your business? Are you planning significant increases in capital expenditures, business assets, product development or number of employees?

Your CPA can help develop financial forecasts, which will predict cash flow needs and prevent cash-shortage emergencies. They can also assist with comparing performance to budget, an exercise which can identify operating areas in need of your attention. This assistance will also make future forecasts more accurate. Furthermore, a good forecast can identify the effects expansion, investments, new product development or new revenue sources might have on your business and anticipate the needs for additional future capital, so you can plan for these needs in advance and avoid cashflow emergencies.

Investments in revenue generators will likely result in a short-term cash drain before the future revenue arises. This is just another reason to get a financial forecast. Your CPA can help navigate through process of creating this forecast and point out any trouble spots before you reach them.

These are just a few of the many reasons for including a financial forecast as part of your recurring financial reporting process, both for your own use, and for the demands of outside investors and lenders.

5. How should I provide financial statements or tax returns to stakeholders outside of my company?

Lenders and investors typically impose financial reporting requirements. It is important to discuss these requirements with your CPA. For instance, if your investors demand audited financial statements, this will require a significant amount of planning — especially in your first year being audited or if your books are not maintained in accordance with U.S. Generally Accepted Accounting Principles (GAAP).

If you have financial covenants in your loan documents, these should be made known to your CPA. They can make certain that these financial covenants are monitored, calculated and disclosed to you in every reporting package you receive, and pinpoint trends that may be leading toward failing these required covenants. Seeing this in advance could allow you to take action and prevent disaster, such as the lender calling the loan due as a result of failure to meet the required covenants.

Furthermore, lenders and investors may not be the only ones who want financial statements. Often large potential customers want to see financial statements to assess your stability, as they do not want to contract with a vendor that is not financially stable. Discuss your requirements to provide financial reports to third parties with your CPA as soon as you know of the demand. You do not want to be late or provide the wrong type of report, so let your CPA have a copy of the document that demands the financial report to assure timely delivery of the correct information.

Whether it is providing financial statement or tax returns to outside institution, share the requirement with your CPA as soon as you know of it, so your CPA can make certain you have timely delivery every time.

6. What is an exit plan? Is my exit plan feasible? Do I really need to write it all down now?

If you do not have a written plan, then you have no plan at all. Every business should have a written exit strategy. Smaller, owner-managed companies that are highly dependent on owner-managers must have not only a written exit plan, but also a thorough, written contingency plan. If your CPA also provides exit planning services by a certified exit planning advisor (CEPA), then there is a potential for extra synergy there. Your CPA already knows your business; you know you trust them. It doesn’t get much easier than that.

The most astute business owner is the one who make certain that his business is exit-ready at all times.

7.What tax and compliance reporting requirements is my business subject to?

Most business are aware of the 1099 filing, which is generally due Jan. 31. However, there are some state and local tax requirements that are less well-known, such as 571L reporting, which entails a county filing based on personal property owned other than land and permanent structure (i.e., buildings and houses). San Francisco’s Gross Receipt Tax is another example of local tax filing requirement, which is mandatory if your company does business in San Francisco. It is important to bring this topic up with your CPA to understand all the tax requirements your business is subject to and plan accordingly so there are no surprises down the road.

Contact Your BPM CPA Today for Assistance With These Matters and More

Your BPM CPA can provide a wealth of information and identify opportunities to significantly improve your financial reporting processes and systems, so that the information provided to you is complete, correct and produced timely. Our professionals can make sure your systems will produce the information you need when you need it. To learn more, contact Winny Wong, Senior Manager in our Advisory practice, today.