Every technology entrepreneur dreams of founding the next unicorn. On the path to that $1 billion-plus valuation, an early-stage valuation can be pivotal for preparing to take the next step.

By Kemp Moyer, Director, Advisory

Many historians trace the origins of Silicon Valley as we know it to a small garage in Palo Alto back in 1939. Stanford University graduates Bill Hewlett and David Packard started working on a line of electronic measuring and testing equipment for their new business called Hewlett-Packard Company. More than 80 years (and thousands of tech startups) later, behemoth Bay Area companies like Apple, Alphabet and Facebook, which all started out as relatively simple ideas, are some of the best-known companies in the world.

Today, there are literally thousands of startups looking for investors to help provide the fuel for rapid business expansion, with grand plans towards the future launch a successful IPO and becoming the next DoorDash, Airbnb or Spotify. Additional routes to future liquidity include being taken to market by a special-purpose acquisitions company (SPAC), or being scooped up by a private equity firm or an established strategic industry leader.

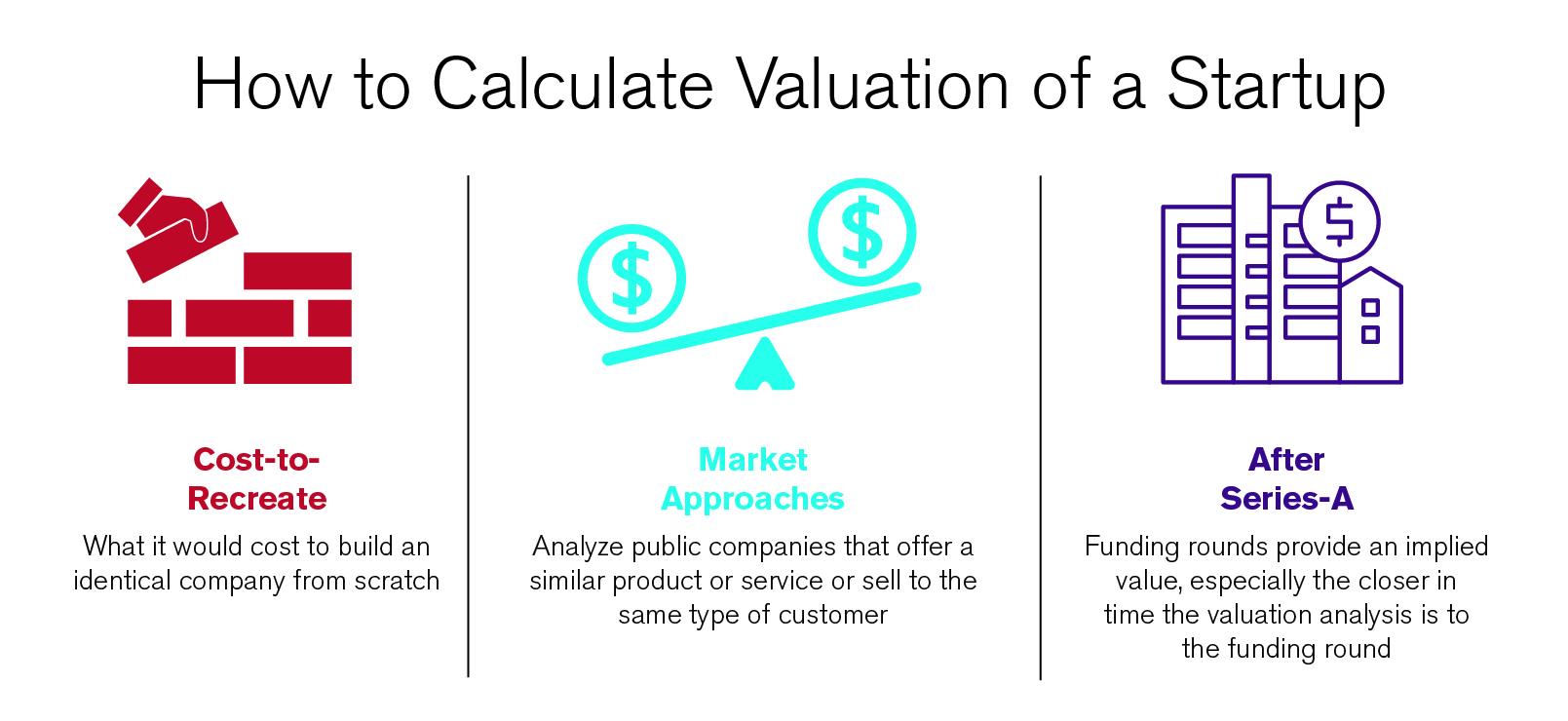

How to Calculate Valuation of a Startup

For a technology startup, getting beyond the seed funding or angel investor stage is usually a challenge. There is an expectation that a new technology company will require substantial capital and time before it can become cash flow positive. However, developing a supportable startup valuation can be helpful in attracting a new round of investors and finding a mutually beneficial deal. It is also essential for tax purposes to have a fair market value when issuing options to management and key employees — and this needs to be done after each round of funding. There are several ways to get a startup valuation, and they all have their strengths and weaknesses:

-

Cost-to-Recreate Valuation: The most basic way to calculate a valuation is the cost-to-recreate method. The idea behind this is to determine what it would cost to build an identical company from scratch. This involves getting a figure for the physical infrastructure (everything from office furniture to inventory) at a fair market price. For a software startup, this would include things like the time it took to create the application, research and development and patent protection. This approach misses some important intangibles, such as intellectual property, the value of a brand, or future potential to generate sales and profit. However, it is often viewed as a starting point and can be a beneficial method for tax compliance purposes.

-

Market Approaches: As a start-up matures, another way to quantify its value is by looking at other companies that may be similar in terms of product, target market or delivery model. This is done by analyzing public companies that offer a similar product or service or sell to the same type of customer and evaluating the multiples in the industry. Additional data points may potentially arise from an analysis of similar transactions in the M&A space. These methods often require significant forecasting of the start-up's potential sales, including developing support for the business's total addressable market and market share assumptions. The difficulty with market methods for very early stage companies is the data sets are often based on more established companies. An early-stage valuation following the market approach thus entails a high degree of forward projection, which requires significant research and support to ensure the valuation holds up when diligence for a new round of funding is taking place.

-

Valuations After Early-Stage Priced Funding: Once a startup has received a round of funding, it becomes more simple to value the company and its equity classes. The Series A (or Seed, B, C, etc.) funding provides an implied value, and the closer in time it is to this round (barring serious negative results or news), the more the indicated price of any equity class will gravitate to the indication of value provided by the round. Farther out — say a year or 18 months down the line — there are several factors that could affect the valuation. For instance, is the company generating sales greater than prior projections, or falling short of plan? Has the broader market provided a substantial boost to multiples or are we facing a bear market? Even if a priced round has been completed at some past date, refreshed analysis and analytics to develop updated value indication become necessary as time progresses.

As one may be able to ascertain from the above, there are nuances to valuation depending on the purpose. If a company is looking to raise equity, the total enterprise valuation desire is for a higher mark. If the company is issuing options, the desire may flip, as option grants may be more beneficial at a lower mark. Always consult with a respected valuation professional and your CPA before taking any action to attempt to reduce or inflate your company’s valuation. There can be pitfalls to pushing too hard in either direction and wise ownership/management will secure proper guidance in the process.

Growing a technology company from the proverbial garage to a multi-building campus takes enormous vision, tremendous management, a superior, innovative product and some luck. To execute the vision, founders and executive teams need to attract investors who are willing to take a risk for a potentially significant reward. For any start-up, knowing what a company is supportably worth can help with navigating the venture capital process. Skilled navigation of valuation is a key to be on the path towards becoming the Next Big Thing.

BPM: Your Partner in Growth

From startup valuation and debt and equity financing, to financial statement preparation and internal accounting controls, BPM’s accounting and advisory professionals have the talent and resources technology businesses need to help drive sustainable growth. Our Technology group possesses years of experience dealing with the intricacies of the Technology industry. In a crowded marketplace, we distinguish ourselves by our deep understanding of the semiconductor, hardware, software, cloud computing and internet, and telecommunication sectors, as well as our extensive experience with a companies of all sizes and at all stages, ranging from venture-backed startup companies to multinational public corporations. To learn more about BPM can help your business, contact Kemp Moyer, Director in our Advisory practice and Head of our Valuations and Appraisals team, today.