Is there a multiple employer plan (MEP) in your future? What about an “open” MEP? If you sponsor a small defined contribution plan, the chances are greater today than they were a year ago, thanks to a liberalization of the Department of Labor (DOL) regulations governing MEPs that took effect last October. But what is a MEP (open or otherwise) anyway, and what’s in it for you?

Defining MEPs

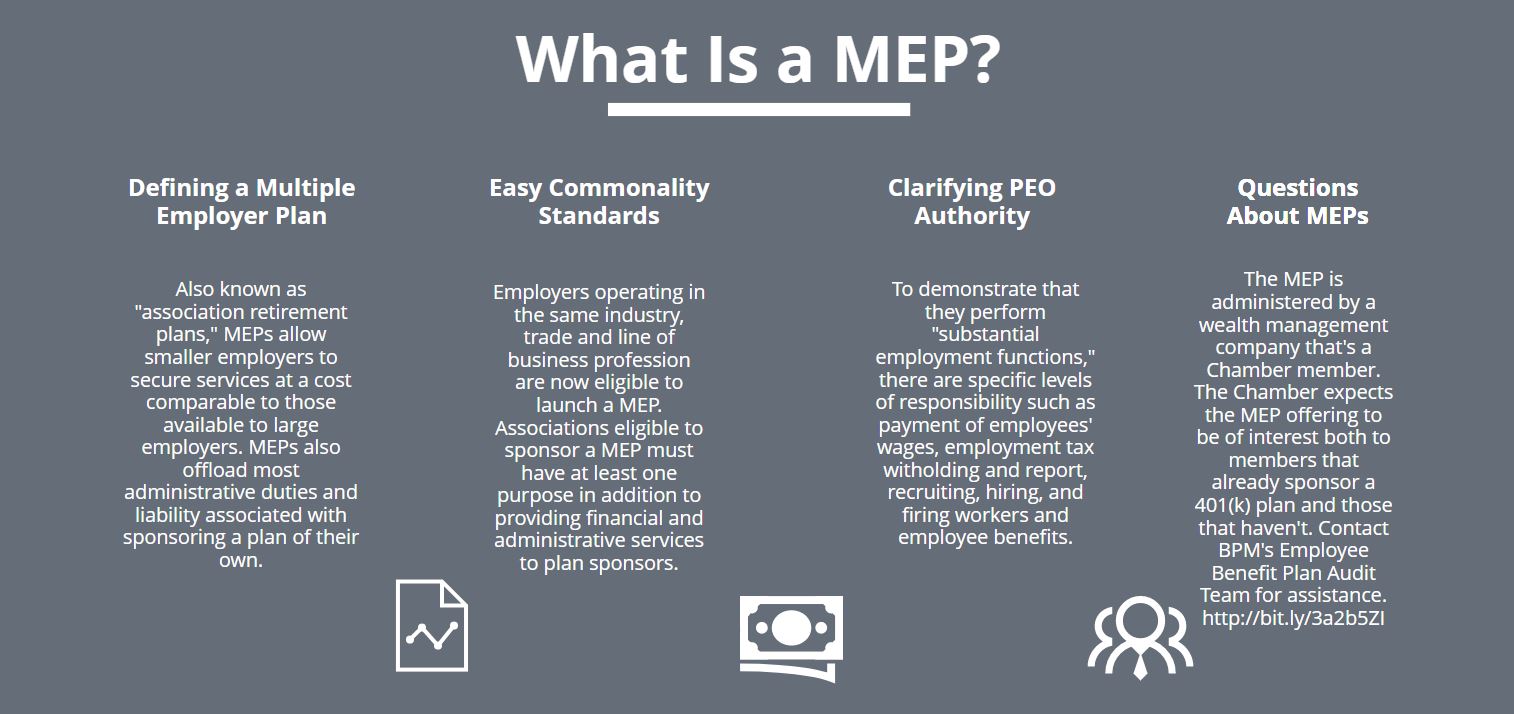

MEPs, sometimes also known as “association retirement plans,” are sponsored by an organization such as a local trade association or professional employer organization (PEO) whose members or clients can adopt the MEP, but not technically be its sponsor. The basic idea is that, by banding together, smaller employers can achieve the economies of scale needed to secure plan administrative and asset management services at a cost comparable to those available to large employers.

Also, MEPs enable small employers to offload most — but not all — of the administrative duties and liability associated with sponsoring a plan on their own. The MEP’s administrator files the annual Form 5500, not the employers that adopt the plan. The DOL regulations treat a bona fide group or association as a closed MEP for purposes of the Form 5500 filing requirements. However, adopting employers are responsible under ERISA’s fiduciary rules for choosing and monitoring the arrangement and forwarding required contributions to the MEP.

Easing Commonality Standards

The DOL has eased its “commonality” requirements for companies to join a defined contribution MEP. Previously, employers had to have a lot in common to be deemed a “bona fide” group or association acting in concert, and thus eligible to launch a MEP. A loose affiliation of companies, or those operating in the same industry but scattered around the country, didn’t pass the test.

Some “commonality” requirements are still in place, but relatively easy to satisfy. For example, employers operating in the same industry, trade, line of business or profession, wherever they are located, can now qualify. So, too, can employers of different industry sectors who operate in the same metropolitan area or state. That’s what has opened the door to local chambers of commerce to jump into the game.

Also, under the new standard, associations eligible to sponsor a MEP must have at least one purpose in addition to providing financial and administrative services to plan sponsors, such as sponsoring a MEP. That means that pension recordkeepers, third-party administrators and financial institutions (such as banks, insurance issuers and broker-dealers) are specifically excluded from MEP sponsorship eligibility.

Clarifying PEO Authority

Most PEOs already offer MEPs to their clients, but the new regulations provide clearer guidelines for them. In particular, the regulations provide a four-part “safe harbor” test that PEOs need to satisfy to demonstrate that they perform “substantial employment functions.” This includes specified levels of responsibility for:

- Payment of employees’ wages,

- Employment tax withholding and reporting,

- Recruiting, hiring, and firing workers, and

- Employee benefits.

Employers that sign on to a MEP retain fiduciary obligations with respect to how they choose and monitor the MEP, as well as relaying employee contributions to the MEP.

Making the Most of MEPs

One organization that was prepared to seize the opportunity to launch a MEP as soon as the ink dried on the new regulations is the Las Vegas Metro Chamber of Commerce. The organization had been closely monitoring the MEP regulations’ progress. It’s believed to be the first chamber of commerce to launch a MEP.

That plan doesn’t charge a setup fee or recurring fees. The plan’s “core expense” covering recordkeeping, administration, participant education, investment fiduciary oversight and plan audit costs is 97 basis points. Asset management fees on individual funds vary and are baked into those funds and netted out of their returns; thus, they’re not covered by the 97-basis-point fee.

The MEP is administered by a wealth management company that’s a Chamber member. The Chamber expects the MEP offering to be of interest both to members that already sponsor a 401(k) plan and those that haven’t yet taken that step.

Will other chambers of commerce around the country follow Las Vegas’ lead? An informal survey of local chambers by the U.S. Chamber of Commerce indicates that many are considering it within the next year or two, but aren’t in a mad scramble to do so.

Looking Ahead

The DOL has been urged to open the doors even wider to MEPs by allowing “open” MEPs that don’t impose geographic or industry sector restrictions. The MEP service landscape could change more rapidly if open MEPs are given the green light by the DOL or Congress. Stay tuned for more.

Is there a multiple employer plan (MEP) in your future? What about an “open” MEP? If you sponsor a small defined contribution plan, the chances are greater today than they were a year ago, thanks to a liberalization of the Department of Labor (DOL) regulations governing MEPs that took effect last October. But what is a MEP (open or otherwise) anyway, and what’s in it for you?

Is there a multiple employer plan (MEP) in your future? What about an “open” MEP? If you sponsor a small defined contribution plan, the chances are greater today than they were a year ago, thanks to a liberalization of the Department of Labor (DOL) regulations governing MEPs that took effect last October. But what is a MEP (open or otherwise) anyway, and what’s in it for you?