San Francisco Business Times

This article originally appeared in the March 1, 2018 issue of the San Francisco Business Times. To view the original article, click here.

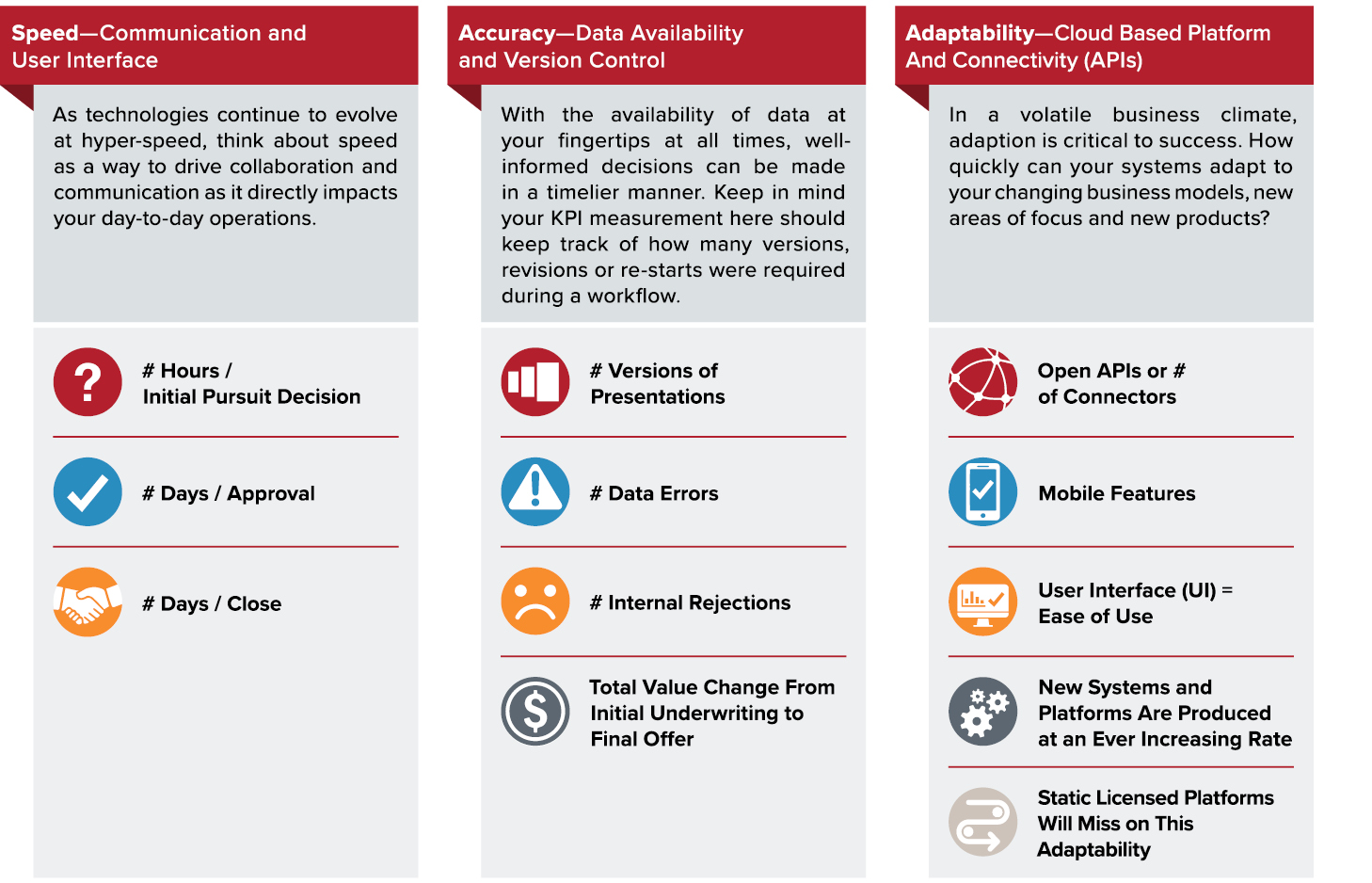

Getting the right deal at the right time is the essence of savvy investing. Attention to key performance indicators (KPIs) is an effective way to help you improve on speed, accuracy, and adaptability. Implementing the right technologies can advance these three metrics for success and help your organization make better investments, faster.

Speed: Communication and User Interface

To stay competitive, investors must operate with speed. Collaboration and communication need to be organized and fluid, both within the team and externally. Commercial real estate technology (CRE Tech) can help you streamline these processes through automation and efficiency-optimized workflows.

Deal management systems can provide your team with a centralized dashboard that in turn allows you to better create, manage and track every element of your projects. KPIs for speed include number of hours per initial pursuit decision, number of days per approval, and the number of days it takes to close a deal. Also think about the time at each seniority level of the team, and who makes the decision to continue to invest resources in a deal or project.

Accuracy: Data Availability and Version Control

Accurate, credible data empowers good decision-making. The more accurate your financial insights are, the greater the value and savings tend to be. That’s why it’s so important that you monitor the accuracy of your data and adjust your timelines to match the caution required.

Thanks to discovery services, it’s actually easier than ever to make better-informed decisions quickly. These tools provide real-time insight into millions of commercial properties, and the information you receive is crowd-sourced and verified by teams of industry experts. This helps you determine the actual cost that it takes to pursue a project and whether it’s worth the risks involved.

Accuracy, as well as time, can be lost by “migrating” data between systems, so using systems that are designed to work together will give your firm the competitive edge. Also make sure to maintain good data hygiene, to ensure that your information is accurate, up-to-date, and secure, especially when you need to proceed with speed.

KPIs for a deal workflow include the number of versions of presentations, number of data errors, number of internal rejections, and the total value change from initial underwriting to final offer. Think of these metrics as a multiplier to the effect of your speed KPI’s.

Adaptability: Cloud-Based Platforms and Connectivity (APIs)

The commercial real estate market is not immune to economic and political changes that could drastically affect financing rates, credit availability, lease rates, and overall access to capital. Leaders and investors must stay abreast of the latest trends and expert predictions to adapt and pivot their business strategies when necessary. Similarly, your systems need to quickly adapt to your firm’s changing business model, new areas of focus, and new products.

Change management is healthier in small, incremental steps. Today’s technologies are ever-more adaptive to small improvements, and allow for your current systems to be augmented or improved. Look for complementary systems that work with core technologies that your firm currently relies upon, but consider if or when those core technologies should be jettisoned too.

KPIs for adaptability should encompass a checklist of features that illustrate the goals of your organization, including number of APIs or open connectors, mobile features, easy-to-use mobile UIs, increasing rate of new platforms and systems produced, and less reliance on static licensed platforms.

Your time is your most valuable asset. Properly implemented, today’s commercial real estate technologies can save you valuable time better spent making more deals or executing better underwriting.

KPIs for Real Estate

Key Performance Indicators can help you quantify your progress, measure incremental success and reach your goals. By measuring these KPIs, you can pivot strategies and make critical adjustments to ensure success.

BPM’s real estate group provides comprehensive “one-stop” accounting, tax and advisory services to those in the real estate industry, such as investors, developers, managers, REITs, and family-owned real estate enterprises.

Mark Leverette is partner and real estate industry group co-leader at BPM, a California-based public accounting and advisory firm ranked one of the 50 major firms in the country. Leverette has over 15 years’ experience working with entrepreneurial companies, and his services include audits, reviews, and agreed-upon procedures.

Learn how to get started on BPM’s CRE-Tech systems by contacting Mark Leverette at [email protected] or call 415-288-6206.