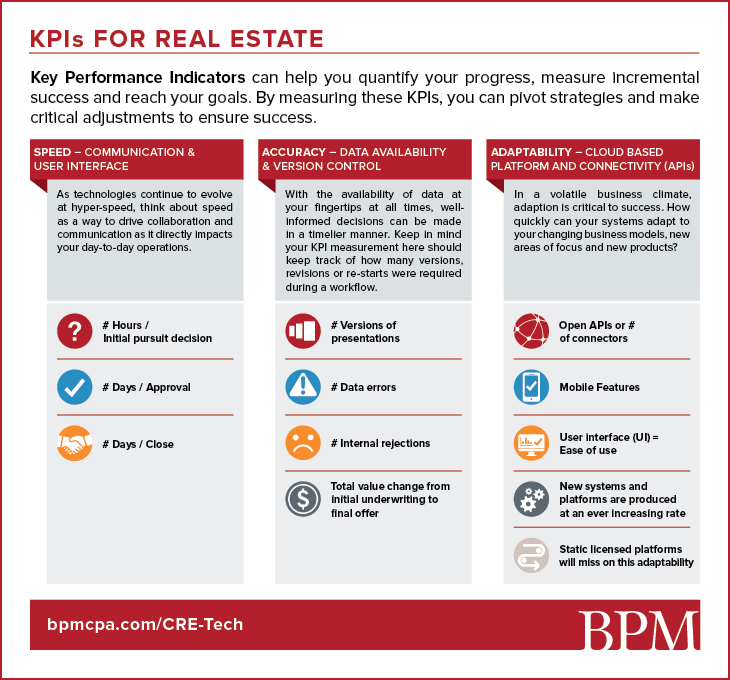

BPM values our advisory relationships with our real estate clients, and we enjoy sharing their successes. To help you continue growing your business, we’ve put together a list of Key Performance Indicators (KPIs) to help you quantify your progress. Some KPIs that make for a successful real estate investment company include an ability to work through deal flow in an efficient and accurate manner. The key to keeping speed while maintaining accuracy is through the adoption of flexible systems. It is important to have goals to work towards, especially in commercial real estate, to monitor incremental success.

Get KPIs for Real Estate by clicking here.

With new software and processes, CRE firms can fully realize productivity and cost benefits from improving:

Speed

Operating with speed in our competitive real estate landscape keeps you ahead of your competitions. With the availability of CRE-Tech that can streamline your processes through automation and workflows, you can optimize for efficiency.

Real-time communication and collaboration will speed up the timeline. It takes a team to drive success and growth, so everyone should be on the same page at all times. Your collaboration and communication need to be organized and fluid across the team and “Externally”. Connecting stakeholders, such as your board or investment committee, with a deal flow, allows you to connect them to the right property at the right time. Deal management systems can give your team a centralized, secure dashboard that allows you to better create, manage and track every element of your projects. Rather than wait for weekly slide decks and analyst presentations, look for systems that allow for collaboration, messaging, alerts, and approval documentation.

Your past deals can provide actionable insights to help you increase efficiency. In this day and age, we should have our own data at our figure tips and have updated templates that are easily accessible. Systems that have well-engineered user interfaces (UI) are key to tracking down the right templates, data, or materials.

Ultimately, it all comes down to how much time you’ve saved through all these processes and technologies. KPI measurements should distill time, and therefore resource investment, into each key stage of the workflow. Most metrics should be measured by days, while some should look at fractions of hours. Think about the time at each seniority level of the team, and who makes the decision to continue to invest resources in a deal or project. As the internet, mobile and social technology continue to evolve, the disruption of the real estate industry is evolving at hyper-speed; and you should too.

Accuracy

Good decisions are made from accurate, credible data. The more accurate your financial insights are, comes higher value and savings. When you are making impactful decisions, monitor the accuracy of your data and adjust your timelines to match the caution required.

With more information available through discovery services on a subscription basis, it’s easier to make better-informed decisions quickly. These tools provide ample real-time insight into millions of commercial real estate properties, and the information you are receiving has been crowdsourced and verified by teams of industry experts. Discovery services can be deployed to reduce pursuit costs that are (frankly) increasing as we approach “the final innings of the cycle.” Determining the actual cost that it takes to pursue a project informs whether it’s worth the investment and risks involved. If you have accurate and relevant data at your fingertips, it can inform your next move and how fast you need to act; it is worth the subscription fee. Don’t let “launch fatigue” affect your team; while opportunistic deals can be vetted quickly with access to the most relevant real estate data at the right time, those dog properties can be left for the next team to pursue.

Look for systems that have open APIs or connectors that allow for multiple systems to communicate (See “Adaptability” below). Until the holy grail of CRE-Technology is invented, you should look to configure your platforms to take advantage of their best features. Accuracy, as well as time, can be lost by “migrating” data between systems. Using systems that are designed to work together or savvy consultants who can configure their APIs, will give your firm an edge.

Keep in mind that errors in your data can occur from time to time, as with all things technology. Maintain good data hygiene to ensure that the information you are working with is accurate, up-to-date, and secure, especially when you need to proceed with speed. Expert service providers can assist in the design of your systems, as well as a test or certification that they are performing their processes with accuracy. If you are relying on systems for financial reporting purposes, the systems should come with recent Service Organization Control Reports.

The KPI measurement here keeps in mind how many versions, revisions, or re-starts were required during a workflow. Think of this metric as a multiplier to the effect of your Speed KPI’s; if you are slow moving and have inaccurate data, this focuses the negative effect on your timelines. Similarly, by improving your data or accuracy alone, you increase the velocity of your deal flow.

Adaptability

In a volatile climate, the commercial real estate market is not immune to economic and political changes that could drastically affect financing rates, credit availability, lease rates, and overall access to capital. Leaders and investors must stay abreast of the latest trends and expert predictions to adapt and pivot their business strategies when necessary. Similarly, your systems need to quickly adapt to your firm’s changing business model, new areas of focus, and new products. In other words, changing markets require new vantage points.

Change management is healthier in small, incremental steps. As it is a systematic approach to dealing with change from an organizational and individual level, taking a proactive approach to dealing with these changes will be less disruptive to your work environment and productivity. It will also ensure a more successful transition due to higher adoption rates by your team. Today’s technologies are ever more adaptive to small improvements, and allow for your current systems to be augmented or improved. Look for complementary systems that will work with core technologies that your firm currently relies upon, but consider if or when those core technologies should be jettisoned too. An example is when a Company relies on accounting software or ERPs that appear to dictate the peripheral systems it can integrate with, or in some cases, is not able to be compatible with any others.

Cloud-based technologies will provide the most flexibility since they will be less centralized, more accessible by other systems, can be improved upon in real-time, and are usually mobile phone optimized. Many cloud systems have connectors that work with an ecosystem of other services or can be integrated through APIs into complementary technologies and data sources. It is important to learn about the vision of the technology company that you are selecting, to see if they will continue to improve their solution and expand their features.

The KPI measurement for adaptability should encompass a checklist of features that illustrate the goals of your organization. Look for features that allow for: wider access for your team and collaborators, ability to integrate with current systems, the ecosystem of connectors to other systems including open APIs, and their technologies vision for future versions and features.

Conclusion

Experts must be able to anticipate the future and adopt new ideas to drive growth. Disruption should be measured to quantify actual progress given the time and effort it takes to implement new systems. Your time is your most valuable asset—measure your savings as time better spent to do more deals or better underwriting.

We specifically did not mention any technologies in this article to allow the readers to apply these KPIs against any CRE-Tech being considered. Think about the time savings, the improved underwriting, and the effort for change management.

The commercial real estate industry is finally seeing truly disruptive technology. Historically, real estate has relied on outdated systems, spreadsheets and CRM tools to store their data. As new systems and platforms are being produced at an ever-increasing rate, new opportunities can be quickly uncovered and a more effective workflow could be adopted by firms. Reducing time requirements and errors impact the bottom line. If you are still using antiquated methods and static licensed platforms, you’ll miss out on a lot of the action. Embrace CRE-Tech platforms, measure your KPIs, and continue to track your progress.

BPM is here to assist you.

If you’re interested in learning more about how to get started on CRE-Tech systems, reach out to Mark Leverette at [email protected] or (415) 288-6206.